Connecting The Digital Oilfield With Modern Wireless Networks

By Renner Vaughn, ABB Wireless

As oil and gas companies continue to persevere in a challenging period for the market, players large and small are looking to digital technologies as a means to increase production, reduce costs and improve operational efficiency. Despite all of the revenue pressures resulting from a down market, the demands of the oil field remain the same. Operators are expected to maintain equipment, monitor inputs and outputs, and optimize production for every asset in the field. The latest Digital Trends Survey from Accenture and Microsoft found that “72% of the respondents believe cost reduction is an important (27%) or the most important (45%) challenge digital can help address.”1 The current downturn is happening at an interesting time for the industry, with new technologies enabling companies to transition to a more connected, digitized operating environment.

At today’s well pad, sensor and meter data are regularly being sent to flow computers and across a field network to backend SCADA systems. These data yield actionable intelligence about the operations on the pad, leading to predictive maintenance, longer equipment lifespans and more focused production. Better asset integrity, gained through remote visibility into the field, helps to keep wells online and pressures and flows more consistent. However, the network required to transport all of this telemetry data from the well pad back to the field office often fails due to out-of-date technology, or even worse, is absent altogether. Operators have admitted off-the-record to some significant losses, up to one million dollars per day, for shut-ins due to communications failure. The good news is that extremely reliable, advanced communication networks are now available to solve the problem.

Cleaner data from the source

Without reliable production data, it becomes difficult for companies to make business decisions that are informed by the daily reality at the wellhead. Engineers and analysts can try to fill in the gaps with models and historical data, but because of communications issues and missing data, key events are omitted from the decision tree. Leading oil and gas players have begun to treat drilling and production data as a company asset. A recent Upstream Intelligence report states that “despite the differences, one thing is clear: operators need to prioritize their well sites to target areas of concern - all to reduce production downtime and enhance the value of human capital.”2 If the results from analyzing big data lead to changes in priorities and focus on more productive wells, then a company can realize substantial revenue increases across all of its assets. Further, if companies are truly planning to do more with less by using timely data to make more informed decisions, then the infrastructure that delivers access to that data becomes more valuable to the business.

Boosting network performance with modern wireless technology

Field communications infrastructure, the critical component of a connected digital oilfield, can be vastly improved with less capital by overlaying modern wireless technology. If companies are slashing budgets for new projects, then boosting performance of an existing system is a great way to maximize prior investments without tackling a full replacement project.

Figure 1

A mix of technologies works best

Leveraging existing or adding more discrete narrowband wireless networks is one option. Utilizing broadband point-to-multipoint (PTMP) systems to reach every well pad is another. Using satellite communications with Very Small Aperture Terminals (VSAT) is common during the drilling phase but not as much during production.

Finally, companies can deploy cellular modems, which are popular in onshore fields because of the proliferation of 3G and 4G LTE network coverage in North America.

However, these options all come with various trade-offs. These trade-offs impact performance of the network in varying degrees, depending on the geography of the field. Factors that must be considered include security, reliability, performance and on-going operational expenses.

A field administrator may ask: Faster speeds are great, but how can a modern wireless technology deliver high performance reliably, especially in unlicensed radio spectrum?

It starts with radio frequency spectrum management. Traditionally, wireless networks used for SCADA (Supervisory Control and Data Acquisition) have been deployed using point-to-multipoint, serial radio technology that operates in the 900 MHz frequency band. This narrow, unlicensed band came into such wide use during the shale boom that RF interference has become a major problem for SCADA managers and field technicians.

Oil and gas leases operated by competing companies are often located on adjacent and even overlapping properties. The SCADA networks deployed by these companies commonly use the same 900 MHz radio technologies, and as a result they suffer from excessive interference caused by neighboring systems. Interference causes transmission interruptions and data loss, leading to reductions in asset integrity and productivity. In many cases, the only way to improve connectivity is to increase radio output power, which has an additive effect as companies try to overpower each other’s radio transmissions. Interference avoidance mechanisms such as Frequency Hopping Spread Spectrum (FHSS) are less adequate when operating in the vicinity of other FHSS systems. One particular operator, who will remain unnamed, has admitted that his organization employs a full-time staffer who spends entire work days visiting each site in the field, manually adjusting radio transmit power in order to keep the system from failing due to signal interference. This is a waste of money; it squanders valuable human resources and causes excess fuel consumption, vehicle wear and tear, and fatigue.

Next comes the subscription model. Cellular providers in North America have been successful at selling cheap Machine-to-Machine (M2M) plans to producers who wanted a quick way to get data from a remote endpoint. In remote areas, this is not an option because there is no cellular coverage at wells and at the pad. Even in areas with cellular coverage, the subscription model can be problematic. According to RootMetrics, the most reliable cellular networks are Verizon Wireless at 95.9% and AT&T at 93.8%.3 This translates into 30 hours of downtime per month for Verizon and 45 for AT&T. In addition to reliability issues, using cellular data services present issues of control for upstream oil and gas companies because important items such as maintenance windows, technology obsolescence, new technology adoption, and networks coverage are in the hands of the carrier, not the subscriber.

So how do companies overcome the challenges without replacing entire radio systems with huge capital expenditure and long project timelines? The answer is to develop a migration path through the introduction of modern wireless technology as an overlay to the existing system.

One size does not fit all

Variance in distance, terrain, RF noise floor and power budgets for remote sites make it very difficult to build a modern wireless network that operates in a single frequency band. Higher frequency bands are capable of extending broadband speeds at impressive distances, but there are limitations imposed by regulatory bodies such as the Federal Communications Commission (FCC). By diversifying the use of unlicensed spectrum, a single wireless network can deliver increased bandwidth while avoiding the interference that has plagued traditional narrowband radio systems.

Broadband mesh is an excellent choice for covering the core of the oil field where its capability to automatically select the best routes through the network from multiple radio frequency (RF) paths, channels and bands provides superior reliability and throughput. Broadband mesh routers also provide enterprise-class security capabilities such as firewalls and IPsec virtual private networks (VPNs).

In many fields, there may also be remote well pads that are isolated and difficult to reach with broadband mesh. There may also be off-grid pads and wells that do not currently have the power budget to support most Ethernet radios. In both scenarios mentioned above, power efficient, sub-1 GHz PTMP radios have for years provided the solution. These devices have traditionally been narrowband radios that supported proprietary communication protocols and provided little or no software functionality. However, a new generation of sub-1 GHz PTMP radios is supporting higher data rates, IP networking and enterprise-class security capabilities. These products complement broadband mesh routers and PTMP radios, filling a lower performance and power consumption niche while providing reliability and security consistent with the technologies used elsewhere in the network.

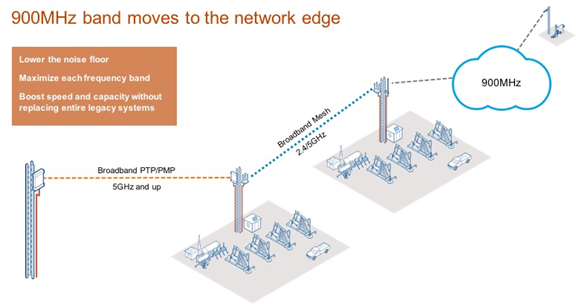

Figure 2

Moving 900 MHz to the edge

By pushing the 900 MHz frequency band farther out toward the edge of the field (Figure 2), the noise floor in this crowded band is reduced, and the network has more entrance ramps to the broadband highway. A distributed, self-healing broadband mesh diversifies the frequencies in use while providing path redundancy and minimizing the need for more towers. The broadband mesh hands off the data to a PTP radio system or to fiber, where it is available. This optimized mix of technologies allows a company to boost performance and develop a migration path over time, as budgets allow.

Securing the field network

Implementing a private modern wireless communications network in the field does present some challenges, of course. However, these challenges are also the answer to some clear vulnerabilities with legacy protocols and technologies. The use of Internet Protocol (IP) and Ethernet-based technologies means that Operations teams must collaborate with IT organizations to put in place the security controls necessary to eliminate vulnerabilities, both externally and internally. A leading producer in California recently expressed concerns over potential exposure to attack with serial-based SCADA radio communication devices that would impact many of their Programmable Logic Controllers (PLCs) in the field. Without encryption and the ability to block certain types of data traffic over the communications system, this company is exposing its equipment to cyber-attacks. Decades-old serial protocols are the main culprit here, as they were not designed with cyber security in mind.

To address the vulnerabilities found in legacy SCADA radio systems, companies should consult with networking experts to design and implement a multi-layer, defense-in-depth security architecture using open security standards. Open standard, enterprise security tools and techniques have been honed for years, and are constantly being updated. Security solution vendors, government-funded organizations (agencies such as CNSS, outside bodies such as CERT) and security researchers constitute a large and active security community around the globe. These groups and individuals discover and publish vulnerabilities and ensure that vendors maintain transparency about the security of their products, and correct any weaknesses.

As a result, oil and gas companies can leverage the past and ongoing work of the enterprise and Internet security community by using a multi-layer, defense-in-depth approach with firewalls onboard every router.

Advancing operational efficiency: the key to surviving the downturn

With business demands increasing as the workforce struggles to keep up, technology should be the enabler. Now that robust, powerful, economical communications technologies are available, companies have the tools to drive down costs across the field. Improving operation efficiency in the upstream oil field depends not only on new technologies, but also on the operating models in place. IT and Operations teams must work together to meet the business demands of the digital oilfield in these uncertain times. With the right field communications plan in place, real-time production data, secure mobile access and cost-saving collaboration across departments becomes critical for leaner, meaner upstream operations.

1 2016 Upstream Oil and Gas Digital Trends Survey, March 2016; Accenture and Microsoft; https://www.accenture.com/us-en/insight-2016-upstream-oil-gas-digital-trends-survey.aspx?c=res_acnenrgytwt_10000260&n=smc_0216

2 Field Automation for Unconventionals: Challenges & Opportunities; Philip Chadney, Field Automation Summit 2015; http://www.upstreamintel.com