Modest Advances in China's South China Sea

By Phil Dickson, Singapore

By Phil Dickson, Singapore

Contents

Location and maritime border disputes(Back to Top)

The Gulf of Thailand would again be excluded, while a resolution of the border dispute between the PRC and Vietnam over the Gulf of Tonkin, is reported to have been reached in 1999.

Historically, China has claimed most of the whole area as its "domestic" waters. However, disputes are restricted to a few parts only, such as the border with Vietnam in the Gulf of Tonkin, already mentioned, and the border with Vietnam to the southeast of the Mekong Delta. The "dormant" claim of China over the Natuna Islands (Indonesia) is another such example.

The most publicized of these disputes relates to the Spratly Islands, because six countries are involved: China, Vietnam, Brunei, Philippines, Malaysia, and Taiwan. However, the overlapping claims never involve the six countries together but are frequently bilateral disputes.

Little is known of the potential of the area for hydrocarbons and it appears that political clout is at stake rather than fishing or mining rights. The parties seem to satisfy themselves in keeping the matter unresolved thus maintaining tension not only with China but between ASEAN member states as well, such as Malaysia and the Philippines.

Exploration results from 1980 to 2000(Back to Top)

The authorities felt that with China's growing energy demand and more specifically that of the southern provinces, it was not advisable to continue sending coal by train to the south, that there was a need to find sources of energy there. Hence the decision to launch offshore exploration for oil and gas and to call on foreign cooperation both for funding and for technology and equipment. Since 1980, numerous seismic campaigns (2D & 3D) have been carried out, and more than 250 exploration and appraisal wells have been drilled, 75% (190 wells) operated by foreign companies in association with CNOOC, 25% operated by CNOOC alone.

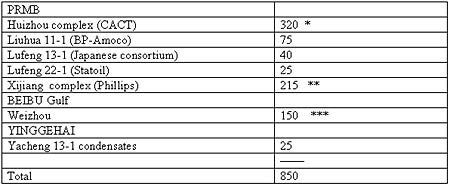

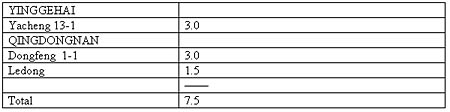

These efforts have resulted in the discovery of approximately 1 billion barrels of oil reserves and 7.5 Tcf of gas reserves (1.3 billion boe). Twenty-seven blocks are now licensed, most as Production Sharing Contracts (PSCs) between CNOOC and foreign partners. The foreign parties bear all exploration costs but CNOOC has the possibility to take up to 51% interest in the development and production phases, an option it has often exercised. These significant results are somewhat mixed when reviewed in detail. The discoveries have been of medium size by international standards, some of them too small or with too high technical costs to justify a development, due to the geological environment.

Geological setup(Back to Top)

Oil and/or gas have been found in commercial quantities in all of these basins. They and sub-basins have evolved during the Tertiary Period with similarities and differences. The PRMB has some marine and some lacustrine source rocks, the three other major basins have mostly lacustrine source rocks. The Yinggehai and the Qingdongnan Basins are mostly gas prone with presence of CO2 in the Qingdongnan Basin. The oils are often waxy and display a range in API gravity from 45 in the Huizhou 21-1 Field (CACT group of CONHE, Agip, Chevron, and Texaco) to 20 in the Liuhua 11-1 Field (BP-Amoco).

Production often comes from fluvio-deltaic clastic reservoirs superimposed in several distinct intervals whose lateral extent is limited by a combination of changes in sedimentology and faulting. In some of these depressions (as in the Beibu Gulf), the depth of burial of the sediments appears to have had a strong influence on reservoir characteristics; porosity and permeability may vary greatly from one faulted compartment to another.

Initial oilwell productivity is high but may decrease due to water influx and/or pressure drops in reservoirs of limited extent. The oilfields have low GORs. The Yacheng 13-1 gas field has a rather low condensate yield of approximately 8 bbl/mmcf.

These elements of heterogeneity need to be detailed on a field by field basis and are mentioned here to support the statement that exploration results are mixed in terms of commerciality.

Reserves and Production(Back to Top)

Of the fields above, the Huizhou complex produces 90,000 bd and the Xijiang complex 75,000 b/d. Current oil production is 250,000 bd (it has reached 282,000 b/d in 1997) and is expected to decline unless further commercial discoveries are made.

Table 2 - Gas Initial estimated reserves (Tcf)

Yacheng 13-1 produces 330 million cf/d, 280 million cf/d sent to Hong Kong for power generation via a 28-inch, 780 km pipeline and 50 million cf/d via a 14-inch pipeline to Hainan for power generation and as feedstock to a fertilizer plant.

Dongfeng 1-1 is currently being developed by CNOOC to supply gas through a 240 km pipeline to Hainan for a fertilizer plant. Production is expected to reach a plateau of 190 million cf/d in 2002.

Recent results, Future activity(Back to Top)

In the Beibu Gulf, both Cairn Energy and Santa Fe Snyder have reported disappointing results that do not bode well of future activity. In the PRMB, Triton and Kerr McGee have relinquished exploration acreage.

Conversely, Santa Fe Snyder have consolidated their acreage position in the vicinity of their Panyu 4-2 oil discovery in PSCA 15/34 reported to be significant after the results of the appraisal well Panyu 4-2-3. Another exploration well in the same PSCA 15/34, Panyu 5-1-1 has recently been reported as a discovery with 320 ft of oil bearing sands split into 20 reservoir intervals (a typical PRMB distribution). Preliminary test results are encouraging.

In the Beibu Gulf, Bligh Oil of Australia, undeterred by disappointing results of previous operators has recently signed a PSC for Block 22/12. Eight wells have already been drilled in the area with discoveries on five structures. As seen previously in the Beibu Gulf, reinterpretation of the existing data and additional works will be aimed at proving the commercial value of these discoveries.

Major Ups & Downs(Back to Top)

The Agip-Chevron- Texaco group (with CNOOC), Phillips, and Arco have successfully brought oil and gas fields in production.

Some parts of the basins remain underexplored and there is room for more discoveries, with reserves size in the range of previous accumulations. This is based on the view that the geological setup briefly described above is a fairly well tested model.

The potential of the deepwater area offshore the PRMB remains unknown. However a water depth of 2000 meters limits the area currently accessible for exploration, development, and production with acceptable returns. The project of an onshore pipeline feeding gas from offshore fields to the coastal areas west and east of Guangzhou may not be justified if reserves are not sufficient.

It might still have to be built with another source of gas. The decision to import LNG has now been made, and a gas distribution grid will probably be needed when the demands of power generation are satisfied.

During the last eighteen months, the interest has somewhat shifted to the Bohai Bay in the northeast. Significant discoveries are reported by Phillips in the Bozhong 11/5 PSC with a development plan under review for the Penglai 19-3 field, reported to have several hundred million barrel reserves of oil with a gravity of 20 API or less. Production could begin in the first quarter of 2001 from five to seven wells at an initial rate of 30,000bd.

Kerr McGee also report a discovery that could lead to a commercial development in their PSCA 04/36 where the well CFD 11-1-1 (Caofedian) has flowed an aggregate 2,483 bd of 17 to 20 API oil from four distinct intervals.

CNOOC had announced plans for a partial privatization through an IPO in New York and in Hong Kong. These plans have been shelved for the time being in view of the lack of enthusiasm of the potential investors. In the meantime, Petrochina, a unit of the China National Petroleum Corporation, with exploration, production, refining, and marketing activities onshore China is filing for an IPO, also in New York and in Hong Kong, aimed at raising US$5 billion.

It would seem easier for foreign parties to value the assets of CNOOC, including upside potential, than those of the giant Petrochina, since CNOOC has a 30-year history of cooperation with foreign companies and a concentration of E&P assets in the South China Sea and Bohai Bay.

The maritime area known as the "South China Sea" is not accurately delineated on maps. It is generally accepted that it extends from the Straits of Taiwan in the northeast, to the Straits of Malacca, between Peninsular Malaysia and Sumatra to the south. Neither the Gulf of Thailand nor the Gulf of Tonkin or Beibu Gulf, limited by the island of Hainan and by the border region between mainland China and the northern part of Vietnam are usually considered as parts of the South China Sea. A definition by default could be that the South China Sea encompasses the maritime areas defined above, on which the People's Republic of China claims sovereign rights. The South China Sea is known for its strategic significance with some of the busiest shipping lanes in the world and with proven or alleged large deposits of oil and gas. Traffic has been active in the region since the early days of trading by sea. Right of way has been a constant concern that has only increased since the mid-1970s with LNG carriers plying from producing countries Indonesia and Malaysia to consumer countries Japan, South Korea, and Taiwan.

The South China Sea is known for its strategic significance with some of the busiest shipping lanes in the world and with proven or alleged large deposits of oil and gas. Traffic has been active in the region since the early days of trading by sea. Right of way has been a constant concern that has only increased since the mid-1970s with LNG carriers plying from producing countries Indonesia and Malaysia to consumer countries Japan, South Korea, and Taiwan.

The following review will deal with exploration acreage, reserves developed or undeveloped, and production mostly from the undisputed part of the South China Sea under supervision and with participation of CNOOC (China National Offshore Corporation) directly or through its regional subsidiaries, CONHW, China Offshore Nanhai West, for acreage west of Guangzhou (Canton) and CONHE, China Offshore Nanhai East, for acreage east of Guangzhou. Exploration works by the Chinese have been intensified towards the end of the Seventies.

The Pearl River Mouth Basin (PRMB) to the east is divided into three main depressions, then east and southeast of Hainan Island the Yinggehai Basin is separated by a high from the Qingdongnang Basin, west and southwest of Hainan. Lastly the Beibu Gulf is divided by basement highs in east-west trending depressions.

Table 1 - Oil Initial Estimated Reserves (million bbl)

* From six separate accumulations

** From three separate accumulations

***From five separate accumulations

Approximately 150 million barrels in accumulations have been deemed non-commercial.

There have been some mixed signals recently regarding future activity in the area of the South China Sea under Chinese jurisdiction. Chevron who had taken up exploration acreage in the vicinity of Yacheng 13-1 (Blocks 62/23 and 63/15) is reported to have had negative results at well Yacheng 24-1-1, a deep well (5,400 meters) with expected high pressure zones. The industry had expressed interest in these two blocks with defined prospects and leads because a significant gas discovery could have easily been tied to the Yacheng 13-1 pipeline to Hong Kong that is not used at full capacity. Chevron is reviewing these results while Arco does not seem to have any plan for exploration. Arco had entered into an agreement with CNOOC to study the feasibility of developing two fields, Ledong 22-1 and its satellites possibly for gas supplies to Hong Kong and Wenchang 19-1, an oil discovery relinquished by Esso. Ledong 22-1 is located west of Hainan in the Qingdongnan Basin, while Wenchang 19-1 is located some 38 km to the southeast of the gas pipeline midway between Yacheng 13-1 and Hong Kong. No report has been made on the results of the study on the Ledong 22-1 Field and satellites. A report that CNOOC would develop Wenchang 19-1 on its own, seems to indicate that Arco has renounced to join into the project.

Chevron is reviewing these results while Arco does not seem to have any plan for exploration. Arco had entered into an agreement with CNOOC to study the feasibility of developing two fields, Ledong 22-1 and its satellites possibly for gas supplies to Hong Kong and Wenchang 19-1, an oil discovery relinquished by Esso. Ledong 22-1 is located west of Hainan in the Qingdongnan Basin, while Wenchang 19-1 is located some 38 km to the southeast of the gas pipeline midway between Yacheng 13-1 and Hong Kong. No report has been made on the results of the study on the Ledong 22-1 Field and satellites. A report that CNOOC would develop Wenchang 19-1 on its own, seems to indicate that Arco has renounced to join into the project.

During 20 years of exploration, there have been significant discoveries but no giant find by world standards. Some of the majors have come and gone such as BP (before the BP-Amoco merger) the Shell-Esso association and more recently Mobil and perhaps Chevron depending on their future course of action. They have had at best, modest success only.