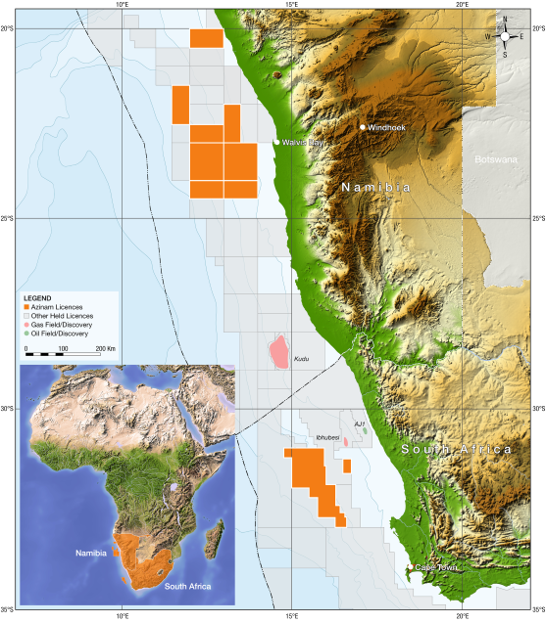

Azinam Makes A New Country Entry, Farming In To Two Licences As Operator In The Orange Basin, Offshore South Africa

Azinam Limited, the Seacrest Capital-backed South West African oil exploration company, is pleased to announce the acquisition of a 40% operating interest in Block 3B/4B and a 51% operating interest in Nearshore Block 3B/4B in the Orange Basin, offshore South Africa, with Ricocure (Pty) Ltd (“Ricocure”) retaining 60% and 49% in the blocks respectively.

The acquisition is subject to government approval and other conditions. The licences were previously held by Ricocure under Technical Co-operation Permits. The Exploration Right applications have already been submitted for both Block 3B/4B and Nearshore Block 3B/4B. The partners anticipate this application to be completed and approved by the beginning of 2019.

The acquisition marks a new country entry for Azinam and will significantly strengthen and diversify Azinam’s West Africa portfolio along this highly prospective part of the Atlantic margin. The licence areas of the two blocks cover 18,530 square kilometres in aggregate with Block 3B/4B located between 120 to 250 kilometres offshore South Africa. The Block 3B/4B licence was previously held by BHP Billiton who acquired a 10,000km² GeoStreamer 3D survey in 2012 which Azinam plans to reprocess. The expected improvement in data quality will help identify the best prospects within the licence. This approach has already been proven on data sets of similar vintage offshore Namibia.

Following completion of the acquisition, Azinam will have one of the largest portfolios offshore South West Africa – totalling 80,530km² – possessing world class prospects within attractive fiscal regimes and benign operating environments. Azinam recently announced its intention to drill several exploration wells in the next 24 months. In addition to assessing the acreage held by Azinam in the Walvis Basin, the drilling campaign is expected to expand to test this newly acquired acreage.

Daniel McKeown, Managing Director of Azinam Limited, commented:

“We are delighted to have farmed-in to these licences in what is a transformational acquisition for Azinam, representing an exciting new country entry and both strengthening and diversifying our position in the wider South West African margin. This acquisition is directly in-line with our strategy to unlock significant value in the region and adds considerable play diversity and scale of prospects. We see this as a natural expansion of our existing offshore Namibia operation and we will be developing our Windhoek office further under the guidance of our VP Exploration, Uaapi Utjavari, who was instrumental in sourcing, evaluating and securing this exciting opportunity. We look forward to working with Ricocure as we identify the best prospects within these licences and bring them towards being drill-ready.”

About Azinam

Azinam holds working interests in 6 licences across 62,000km2 of the Walvis basin offshore Namibia. Azinam’s partners on these licences include Tullow Oil, Maurel et Prom, ONGC, NAMCOR, Eco Atlantic Oil and Gas and Chariot Oil and Gas. Azinam recently announced a farmout to ExxonMobil.

Namibia is an under-explored continental margin with significant hydrocarbon potential in two main basins, the Walvis and Orange Basin, the latter straddling the Namibia/South Africa border. Both Basins are gaining increasing industry attention from the international oil industry. Recent new entrants include ExxonMobil, Total, Lundin group (through Africa Energy & Pancontinental) and ONGC. Backed by Seacrest Capital Group, Azinam is leveraging its technical strengths to unlock the significant potential of 10billion barrels of net unrisked prospective resources on Azinam licences in the Walvis Basin. The acquisition of two new licences within the Orange Basin with will significantly enhance this position.

A combination of heightened industry interest along this part South West part of Africa with wells now planned in 2018 and 2019, coupled with recent licensing and exploration success in geologically analogous regions within the South Atlantic margins, including the Falkland Islands, Brazil, South Africa and Angola, has made the region one of the most attractive potential hydrocarbon provinces in the global arena. For more information, visit www.azinam.com.

About Seacrest Capital Group

Seacrest Capital Group is a leading independent energy investor specialising in offshore oil and gas investments, leveraging its proprietary assets, relationships and operational and technical capabilities to build a diversified, global portfolio of regionally focussed oil and gas companies. Since 2010, Seacrest has invested in a number of successful upstream oil and gas companies in the United Kingdom, Norway, West Africa, Ireland, South East Asia and South America.

Source: AziNam Ltd.