Operators Poised to Drill US Transition Zone Inventory

by Jerry Greenberg, Houston

Seismic Activity

High fees affect seismic activity

Inland Water Drill Barge Activity

Inland Barge Dayrates Holding

Activity in the US Gulf of Mexico's transition zone felt the effects of lower oil prices last year and is now feeling the effects of higher oil prices. The fluctuating oil market has affected seismic and E&P activity, inland water drill barge utilization and dayrates.

Seismic Activity(Back to Top)

Seismic activity along the Gulf Coast, as well as on the shelf and in deep waters of the Gulf of Mexico has slowed significantly from a year ago, partly due to the oil price situation. More than enough seismic was shot earlier but low oil prices a year ago resulted in drilling prospects being deferred until oil prices settle. Also, an onerous seismic permit fee structure in Louisiana has slowed the industry's activity level, resulting in some planned seismic shoots being cancelled. That fee is now the subject of a lawsuit.

"The consensus in the Gulf of Mexico is that there is an oversupply of prospects because the seismic industry did so well and shot so much data that the industry, when times went bad, stopped drilling them," said Marc Lawrence, Senior Vice President of Fairfield Industries in Houston.

"When things begin to get better for the operators," Lawrence continued, "they have this inventory of drilling prospects that they need to drill before they are ready to start forward with more seismic."

"Now that oil prices have reached higher levels," said Charles Darden, President of the International Association of Geophysical Contractors (IAGC) in Houston, "they have begun to drill those prospects. But until they reduce or eliminate that inventory of prospects there is not going to be a strong demand for new surveys."

But when will enough prospects be drilled before demand for new seismic occurs? "Possibly before yearend," Darden said, "but most people agree definitely by early next year."

Still that scenario does not bode well for a seismic industry that will be entering its traditionally busiest season. "In the past in the Gulf of Mexico, there have been 20-30 seismic crews operating," Lawrence said. "This year the industry is anticipating three to six crews during the summer, the peak season."

While that is a significant decrease in crews counts, today's crews and the technology they use are much more efficient in data collection than even a few years ago. Consequently, more data is being collected with fewer crews. "The technology is continuing to advance so much that we are literally doing it faster, better, and cheaper than ever before," Darden said.

Despite the abundance of seismic data, some seismic contractors are continuing to shoot speculative data, where they pay most of the costs of acquiring that data and then license it to the oil companies, because they believe that the data they are shooting is going to be needed by the exploration companies. They are anticipating the areas that previous data collection and drilling activity are suggesting as the next places that exploration activity is going to occur, or where it is likely to increase.

High fees affect seismic activity(Back to Top)

A costly per acre fee implemented a few years ago by a Louisiana state agency has literally forced some seismic contractors to pull planned shoots from their schedule. The Louisiana Department of Wildlife and Fisheries (DWF) implemented a $60 per acre fee if a seismic shoot crosses or includes land that is under their management and control. The Louisiana Department of Natural Resources (DNR), however, is the agency that actually issues the permits that allow seismic data acquisition.

"The DNR fee is $11,000 for nine square miles," said Don R. Briggs, President of the Louisiana Independent Oil & Gas Association (LIOGA). "That comes to roughly $2 per acre."

DWF has been charging the $60 per acre fee for about three years. LIOGA filed a lawsuit last February to try to stop DWF from charging the fee, saying that the agency does not have the statutory authority to levy that fee.

"We tried a lot of other remedies to get Wildlife and Fisheries Secretary Jim Jenkins to come to reason," Briggs said. "But after doing many different things we found that weren't going anywhere so to put a stop to it, we had to file suit against them."

Part of the lawsuit is an injunction hearing to halt the fee, which is scheduled for April 6, according to Briggs. The lawsuit will follow that. "I think the lawsuit could be relatively quick," Briggs said, "Since the only thing we are challenging is statutory authority, and that makes it pretty simple."

Seismic companies are not conducting surveys because the fee makes it uneconomical, says Briggs. The DWF was trying to raise money, he said, and they saw this fee as a way to do that. "They could have raised a lot of money with (the fee) but it didn't last very long," Briggs said. "One company alone paid about $4 million of those fees for a proprietary seismic shoot, but since then (collections of the fee) have been miniscule."

But fee collection has been low because seismic companies have refused to conduct surveys on lands where the fee would be in effect. "There are some shoots I am aware of that have been pulled," Briggs said. "And that's not good for business."

Inland Water Drill Barge Activity(Back to Top)

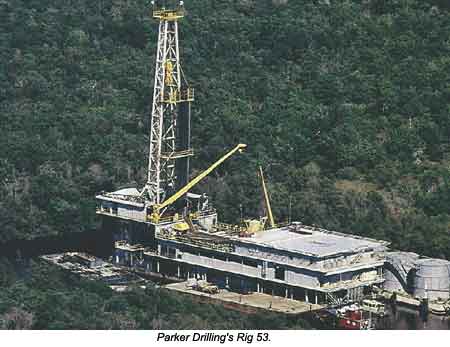

Inland water drill barge utilization in late March stood at 32% of the total fleet and slightly better for the marketed supply utilization. There are still only two major inland water drill barge contractors, R&B Falcon and Parker Drilling, which combined controls 86 of the 96 units (90%) in the Gulf of Mexico. The remaining companies are Nabors Offshore with three rigs and Tetra Technologies with the remaining seven units.

While overall utilization of the inland water drill barge fleet stood at 32% with 31 units contracted, utilization of the 70 units in the marketed fleet was somewhat better at 44%, according to figures from Offshore Data Services, Inc. (ODS) in Houston.

Of the two big players, in late March, Parker Drilling was faring much better. Parker posted an 84% utilization rate with contracts on 16 of its marketed fleet of 19 inland water drill barges. Nine of its barges were cold stacked. R&B Falcon, on the other hand, had a 25% utilization rate of its working and ready fleet of 44 units with only 11 contracted. The company had 47 idle rigs including 14 cold-stacked units.

"In the case of our larger rigs," said Val Rein, Vice President of Sales and Marketing for R&B Falcon's inland division, "We have a crew on them to keep them running so they are ready to enter the marketplace whenever the market is ready."

"They could be ready to go with just a matter of crewing them," Rein said. "Of course, crewing them may be a bit of a problem in this industry."

Getting crews could be a problem the contractors may have to face as the outlook for increased activity is hopeful. This is primarily because of the major operators moving out of the transition zone and into deepwater and international areas. "I think the opportunities are going to be tremendous for the inland barge business," Rein said, "because the majors are moving into deepwater. It is allowing the independents to pick up properties both along the shelf and inside the transition zone giving them opportunities they didn't have before. The majors have been sitting on some of these properties for decades."

"And where a major may have an opportunity to make a go of an old field because of their structure, the independents can make a ton (of money) on it," Rein said. "I think there is a heck of an opportunity for independents with the majors exiting the transition zone."

Deep drilling may be the key for independents. "We are seeing opportunities to drill deeper horizons and we've made some pretty good discoveries," Rein said. "Not deeper than you would find offshore but deeper than historically drilled inside Louisiana. A lot of the wells before have been normal pressured 12,000-14,000 ft wells. We really have not scratched the surface when you talk about 18,000-20,000 ft wells. That is where the real opportunity wells are."

Toby Begnaud, Parker Drilling's Manager of Contracts and Marketing for the North American Group, agrees: "We have seen real changes in the past two years of the core major operators in the inland area moving out in favor of independents. Texaco, Amoco, and Pennzoil sold a number of their fields. The major operators that have held onto these fields are spending in deepwater and internationally and away from the domestic transition zone."

"It has taken some time for the independents to get up to speed," Begnaud said. "What they have done is the cheapest non-rig work they could do to get those fields on line and in place, such as wireline, snubbing, anything they could do to increase production."

So while there is optimism on the part of the two major inland water drill barge contractors, they are cautious as well.

"I believe if we see a continued strong product price we are going to see people try to take as much advantage as they can," Begnaud said. "I think we are going to see this continue to improve. But you have to look at this from the backside as well. "It's a lot easier for an independent to stop activity than a major, and that's always a problem."

Inland Barge Dayrates Holding(Back to Top)

Dayrates suffered somewhat due to the transition from the majors to independents. However, they have remained fairly steady from a year ago, primarily because of the unique market and the fact that with only two major players the available fleet of drilling barges can be controlled.

Depending upon what an operator requests, dayrates today for the large drilling barges average between $17,000 and $17,500. Extra rig hands or a rig with a top drive drilling system could command from $17,500-$19,500, according to Rein. But both Rein and Begnaud say rates could get even higher once the independents become active.

"I think we will continue to see a gradual increase in rates throughout the year," Begnaud said. "We could exceed $18,000."

Rein is more optimistic. "Rates could go up into the very high teens and possibly low twenties in some cases when the independents begin getting active. That depends on the backlog of work and how much activity is out there. But even going back to the 1980s boom days when we had 120 barges working, the top rates were only about $18,500."