Caspian Emerging as Major 21st Century Producer

by Dev George, Baku

Contents

Export Pipelines

Azerbaijan

Kazakhstan

Russia

Turkmenistan

Iran

A turning point has been reached in the Caspian region. Not only has the tangle of pipeline possibilities for exporting Caspian crude to world markets finally begun to be unscrambled, but optimism has been bolstered enormously be new estimates of regional reserves that have recently been increased exponentially by several major discoveries.

Remnants of the Soviet heyday in the Caspian abound in the environs of Baku, capital of Azerbaijan and, by some accounts, the Aberdeen of the region. And, if one looks closely, the relics can be seen of a century ago, when the Rockefellers, Rothschilds, and Nobels built their fortunes here by producing nearly half the world's oil from the Caspian and its shores.

Despite the environmental degradation of the rusting and leaking onshore Soviet oilfields that stretch to the horizons both north and south of Baku, and the sight of derelict rigs offshore, the Caspian is definitely experiencing a comeback.

According to Sue Whitbread, managing director of Petresearch Ltd, of the UK, at least US$90 billion may be spent on planned and possible new field projects throughout the Caspian region, exclusive of exploration expenditures. Some 21 projects lead the field, she says, each set to cost $1-12 billion. And, she adds, project facilities and infrastructure will reach $3 billion a year by 2005.

Export Pipelines(Back to Top)

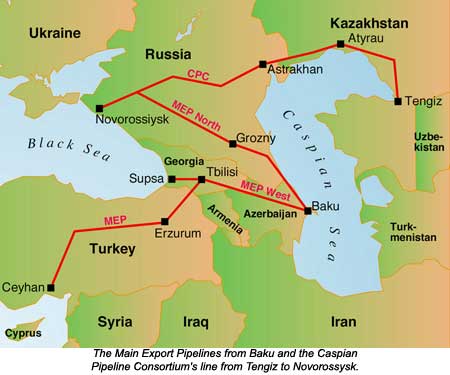

A plethora of pipeline possibilities has plagued development of the Caspian for half a decade, scattering the focus and diverting attention from exploration and development to political posturing and efforts at gaining precedence and the foreign investments it would bring. Now, however, with the final signing of the regional accord by Turkey, the Main Export Pipeline (Baku to Ceyhan on the Mediterranean coast of Turkey) has been settled and simply awaits construction.

Other export lines, however, have already gone into limited operation, including that from Baku to Tbilisi and on to Supsa, and Baku to Novorossysk, both terminating at the Black Sea. Still others are being touted by various national interests, including westbound lines through Romania and Bulgaria and perhaps Greece, and across the Caspian from Turkmenistan to Baku and on to Turkey; southbound lines through Iran to either the Persian Gulf or Turkey; and even eastbound to China.

Thus, solution of the problem of export and the recent major discoveries in the region have provided the optimism and extra stimulus for new investment and renewed exploration, development, and production activities.

Azerbaijan(Back to Top)

Azerbaijan has always been the focal point of the Caspian petroleum industry, and continues to be today. Riding the crest of the Absheron Sill, a geological extension of the Caucasus Mountains that divides the Caspian into an oil-prone north and gas-prone south, it shares both sectors, thus has numerous oil reservoirs along the Sill and gas reservoirs to its south.

According to President Heydar Aliyev, some 19 contracts with a value of US$60 million have been signed with 33 international operators from 14 countries, and a total of $3 billion has already been invested in development of both on and offshore Azeri oil and gas fields.

Among the country's post-Soviet developments, the 5 billion bbl Azeri-Chiraq-Guneshli (ACG) unitized field led the return of major international oil companies to the Caspian. Now operated by the Azerbaijan International Operating Company (AIOC), with BP Amoco at the helm of 11 interest holders, ACG is now producing 110,000 b/d of oil in its Early Oil Project that are currently being exported via both functioning pipelines. By 2006, with the Main Export Line operational by 2004, it should reach peak production at 1.2 million b/d.

David Woodward, president of AIOC, says the development design work for the first phase of the full development of ACG should be completed in August, when construction tenders will be issued. One or two minimal facilities production platforms are to be built on the Chiraq Field—one a drilling and production platform, the other , if needed, a gas compression installation linked to the first. A platform is planned for the western sector of the Azeri Field for production by 2004, and another for the deepwater section of Guneshli by 2005. A new 30-inch pipeline will also be laid from ACG to the Sangachal terminal, and as many as nine new, extended-reach wells will be drilled. Full development, a total of four phases at a cost of US3.3 billion, will push production to 800,000 b/d oil bby 2008-10.

Ramco's shallow water Guneshli development, in partnership with TotalFinaElf and Socar (State Oil Company of Azerbaijan), is also in the planning stage for possible redevelopment by 2004. It is believed to contain over 700 million bbl oil.

Undoubtedly, the second most encouraging event in Azerbaijan has been the confirmation of the size of the offshore Shah Deniz gas/condensate field south of Baku, at 35 tcf, assuring that Azerbaijan will become not only a producer but an exporter as well of natural gas, with a potential of export of 60 bcm by 2010-20, according to Natig Aliyev, president of Socar, who says an Early Gas Project for Shah Deniz and the Azeri-Chiraq Field, scheduled for 2003, could see as much as 3 bcm being exported to Turkey and Georgia.

BP Amoco and its partners are planning to kick off development of Shah Deniz with a first stage, two-platform project on the field's northeast side, with drilling slots for as many as 20 wells. Product will be pipelined to the Sangachel terminal for transmission to market.

BP Amoco's other prospects, Inam and the Araz-Alov-Sharg fields, await the upgrade of the Dada Gorgud semisubmersible and the availability of the Istiglal, respectively. Inam seismic was shot last year, and its first well is expected to be drilled in September at the earliest. The AAS field is in deep water at 500 meters. Its seismic was also shot last year, but drilling isn't expected until 2002-03.

Agip's Kur Dashi prospect holds great potential, too. Expected to hold 500-800 million boe, it is now being drilled by the Istiglal in a water depth of 104 meters.

The Lenkoran Block, held by TotalFinaElf and partners, is estimated to have a billion bbl oil reserves. A well is to be spudded there in the fall to confirm this estimate using the newbuilt Transocean Sedco Forex jackup Trident XX, now in its final stages of construction in Baku. The block iis in an environmentally sensitive area near the Kurkossa Island nature reserve, and is also very close to the Iranian frontier.

Muradkhanli, Ramco's sleeping onshore giant beside the Gobustan desert and just 70 miles west of Baku, is the third major project Azerbaijan is pinning its hopes to. [See upcoming exclusive interview with Ramco's managing director Michael Burchell and Phil Maxwell, president of the Muradkhanli Operating Company.] Seismic is about to get underway to prove estimated reserves of more than 5 billion bbl oil. This will be followed by a number of exploration and appraisal wells next year, with a goal of rehabilitating the field to produce at least 1,500 b/d.

Kazakhstan(Back to Top)

Although most of the Caspian's activity has been concentrated in Azerbaijan's aquatory, Kazakhstan, with over 200 discovered fields, can still lay claim to the largest and most exciting discoveries to date: the onshore Tengiz and Karachaganak Fields, and the enormous Kashagan Field offshore in the shallow waters of the northern Caspian. Optimism is at its highest—Kazakh President Nursultan A. Nazarbayev says he expects his country to rival Saudi Arabia in oil exports by 2015, with some 8 million b/d. But both the lack of infrastructure and an adequate export pipeline have prevented the pace of development of the two proven giant onshore fields and restricted investment in the area until now. The 1,500 km, 1.34 million b/d Caspian Pipeline Consortium (CPC) line through Russian territory is now under construction from Tengiz to the Black Sea, however, and is expected to be operational by the fall of 2001, alleviating the current bottleneck in getting maximum production to market from Tengiz and Karachaganak.

Tengiz is currently producing approximately 215,000 b/d but undergoing an expansion that will boost that to 260,000 b/d. Its recoverable reserves are estimated at 6-9 billion bbl.

Karachaganak, with reserves of 2.4 billion bbl oil and condensate and 16 tcf gas, is presently producing 175,000 b/d condensate and 500 million cf/d gas. At its peak, it will be producing 260,000 b/d condensate and 1.4 billion cf/d gas.

Kashagan, however, is another question. A super-giant, it is believed to be one of the world's four or five largest oilfields, is thought to be more than three times the size of Tengiz, from 8 to more than 50 billion bbl oil, and will require a totally new pipeline to handle its export production. Further delineation drilling by the Shell Oil-led Offshore Kazakhstan International Oil Co. (OKIOC) is ongoing, but it is already known that its reservoir covers some 2,000 square miles.

At this date, the structure's bottom has yet to be reached, making it very promising.

Russia(Back to Top)

According to analyst Sue Whitbread of Petresearch Ltd, the Russian sector of the northern Caspian is likely to be the site of several large discoveries, but so far, only one has been made: Lukoil's 2.19 billion bbl Khvalynskoye oilfield in the Severny license area west of Kazakhstan's Kashagan discovery. Lukoil, using the Astra jackup rig, but planning to employ the Shelf 7, now being reconditioned, plans to drill eight more exploratory wells and as many as 200 developmental wells in the license area. According to Vagit Alekperov, Lukoil president, the Khvalynskoye discovery provides confidence that there is oil in the Russian Caspian. Lukoil holds an exclusive license for all of the Russian Caspian aquatory.

Turkmenistan(Back to Top)

Turkmenistan's latest estimate of its reserves is 11 billion tons of oil and a phenomenal 777 tcf of gas. Slow to gain international investment and to develop its reserves, however, the country is now setting its hopes for export markets on several pipeline schemes, most of which have stalled, including the ambitious TransCaspian Pipeline to Turkey and a much discussed pipeline to China.

Turkmen Caspian offshore prospects are few at this time—Livanov, Barinov, Shafag, LAM Bank, Zhdanov, and Cheleken—none of which are exceptional producers. The important play is the gas-prone Amu-Darya Basin of eastern Turkmenistan and western Uzbekistan, which holds significant potential. To date, however, the largest field is the Dauletabad-Donmez in southern Turkmenistan, with reserves fo 60 tcf gas.

Iran(Back to Top)

Although Iran shares the Caspian with its neighbors, it has practically no exploration and development of the area. Instead, it is pushing to be a provider of a pipeline export route to Turkey and to the Persian Gulf. To date, neither prospect has reached the point of serious consideration.

Analyst Whitbread says that the scale of future projects could justify new investment in the Caspian, particularly in the supply and service infrastructure. She says the prospects are excellent for future industry activity. "Potential investment opportunity exists across the board, not least in the further participation in exploration and development. As many of the PSCs in the region reach a stage of requiring substantial financing, changes and consolidation of oil company participants is likely to occur in order to secure the necessary investment to complete future programs."