Chevron and Texaco in US$100 billion merger create 4th largest major

Chevron Corp. and Texaco Inc. are merging to create the world's 4th largest oil major, ChevronTexaco, and join the ranks of other combined supermajors—ExxonMobil, Royal Dutch/Shell Group, BP Amoco, and TotalElfFina. Long-time partners, the two companies have had a close relationship for decades. For more than 55 years, they have co-owned Caltex Corp., which sells 1.8 million bbl of crude oil and petroleum products per day and operates in 55 countries. Chevron tried to buy Texaco last year, but those talks broke down due to disagreements over price and issues of control.

Chevron Corp. and Texaco Inc. are merging to create the world's 4th largest oil major, ChevronTexaco, and join the ranks of other combined supermajors—ExxonMobil, Royal Dutch/Shell Group, BP Amoco, and TotalElfFina. Long-time partners, the two companies have had a close relationship for decades. For more than 55 years, they have co-owned Caltex Corp., which sells 1.8 million bbl of crude oil and petroleum products per day and operates in 55 countries. Chevron tried to buy Texaco last year, but those talks broke down due to disagreements over price and issues of control.

The new ChevronTexaco will have world-class upstream positions in reserves, production, and exploration opportunities; an integrated, worldwide refining and marketing business; a global chemicals business; significant growth platforms in natural gas and power; and industry leading skills in technology innovation.

The combined company expects to achieve annual savings of at least $1.2 billion within six to nine months of the merger's completion, mostly by the elimination of about 4,000 jobs, or seven percent of the 57,000 combined jobs at Chevron and Texaco.

The merger, to be accounted for as a pooling of interests, is expected to become accretive to the new company's earnings and cash flow per share upon realization of the savings. The company also expects to improve capital efficiency by funding the best growth opportunities of Chevron and Texaco, resulting in improved return on capital employed over time.

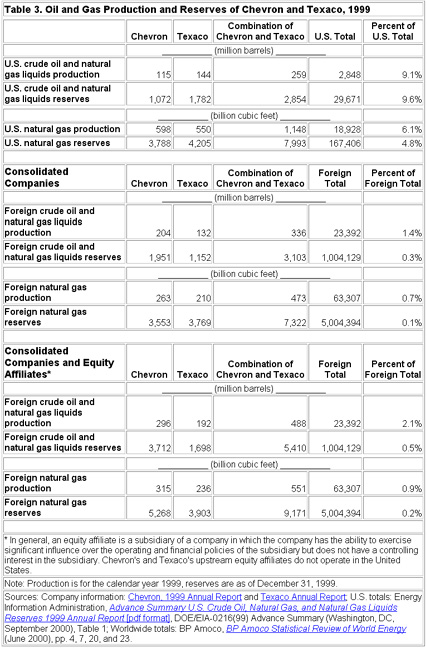

The new company will have reserves of 11.2 billion bbl of oil equivalent (boe), production of 2.7 million boe/d, assets of $77 billion, and operations throughout the world. In the United States, ChevronTexaco will be the nation's third largest producer of oil and gas, with production of 1.1 million boe/d , and will hold the nation's third largest reserve position, with 4.2 billion boe of proved reserves.

In the merger, Texaco shareholders will receive .77 shares of Chevron common stock for each share of Texaco common stock they own, and Chevron shareholders will retain their existing shares. As a result of the merger, Chevron shareholders will own approximately 61% of the combined equity, and Texaco shareholders will own about 39%. The combined company would have an enterprise value of more than $100 billion.

Dave O'Reilly, Chevron chairman and chief executive officer, will serve as chairman and CEO of ChevronTexaco, which will be headquartered in San Francisco. Peter Bijur, Texaco chairman and CEO, will become a vice chairman of the combined company with responsibility for downstream, power, and chemicals operations. Richard Matzke, Chevron vice chairman for upstream operations, will retain those responsibilities in the combined company. The composition of the ChevronTexaco board of directors will be approximately proportional to the equity split and will be drawn from current members of the Chevron and Texaco boards. Chevron vice president and CFO John Watson and Texaco senior vice president and CFO Patrick Lynch will lead the integration process.

Significant cost savings

The combined ChevronTexaco expects to reduce costs by at least $1.2 billion per year within six to nine months of the merger's completion. The most significant savings (approximately $700 million) will come from more efficient exploration and production activities, but other areas will contribute as well, including some $300 million from the consolidation of corporate functions and $200 million from other operations. The companies anticipate that the combined workforce of about 57,000 will be reduced by approximately 7% worldwide. Anticipated cost savings build on both companies' track records of successfully achieving cost reductions.

Upstream leaders

The combined company will be a major global upstream competitor, with a leadership position in most of the world's major and emerging exploration and producing areas. ChevronTexaco will have world-class reserves and growth opportunities in both west Africa and the Caspian region, where, in the latter case, the new company will solidify its position as the largest producer. In addition, the combined company will have a superior exploration acreage position in the most promising deepwater areas in west Africa, Brazil, and the US Gulf of Mexico. The combination will significantly strengthen positions in core producing areas in North America and the North Sea. Further, the combination will create an outstanding portfolio of growth opportunities in Latin America and the Asia-Pacific region.

The merger is conditioned, among other things, on shareholder approval for both companies, pooling accounting treatment for the merger and regulatory approvals of government agencies such as the US Federal Trade Commission. Chevron and Texaco anticipate that the FTC will require certain divestitures in the US downstream in order to address market concentration issues, and the companies intend to cooperate with the FTC in this process. In that regard, Texaco is in discussions with its partners in the US downstream.

Click here for related story on ChevronTexaco in West Africa .

Edited by Dev George

Managing Editor, Oil and Gas Online