Nigeria's Deepwater Province Taking Off Now That New Government in Place

Lagos, Nigeria

Contents

The cancellation of licenses for 16 ultra-deepwater oil leases granted between January 1 and May 28, 1999 by the former military government in Nigeria suggests that a new bid round may be in the immediate future. The new civilian government annulled those awards on grounds of propriety. The cancellation, announced on July 6, 1999, was made on the advice of a panel set up to review the awards, and it came less than a month after the awards were ordered suspended. (The last open bidding round for oil leases in Nigeria was conducted between 1991 and 1992.)

The independent local newspaper The Guardian said the cancellation "came ahead of the development of a new procedure for bidding and allocation of licenses and acreage by the new government," and reported plans to review the five-year-old indigenization policy that restricted awards solely to indigenous entrepreneurs. Under this policy, local companies signed PSCs with the Nigerian National Petroleum Co. (NNPC), then offered technical partnerships to foreign companies at 40% equity.

The policy encouraged abuses. The 16 ultra-deepwater leases, in water depths of 1,500 to 3,000 meters, were awarded to several indigenous companies that were reportedly fronts for the departing military generals. As a consequence, multinational operators demurred partnerships with the leaseholders.

President Olusegun Obasanjo appointed OPEC Secretary General Rilwanu Lukman special adviser and Gaius Obaseki managing director of NNPC. Lukman is highly favored among the oil majors in Nigeria for fighting for their autonomy from NNPC control when he was minister. No minister of petroleum affairs was appointed.

New Frontier (back to top)

Nigeria's deepwater is its new frontier. When the open bidding round occurs, companies like Chevron, desperate to own its own deepwater leases, and Mobil, which relinquished its leases for lack of good prospects, will have the opportunity to canvas for prospective acreage.

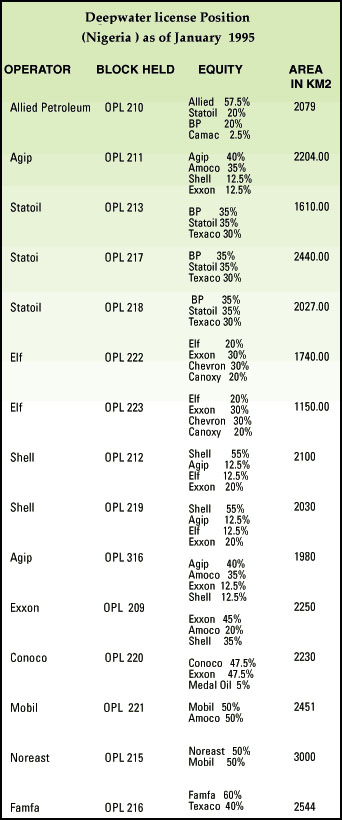

The Statoil/BP alliance has the largest holdings as a result of the 1991 Round—operatorship of OPL 213, 217, and 218, all in the western segment, and a 40% technical partnership in OPL 210 with the indigenous company Allied Petroleum. Shell, Elf, and Agip hold two leases each, with Mobil, Conoco, and Exxon holding but one. Allied Petroleum was the only indigenous company granted a 1991 lease.

Two years later, the government awarded one lease each to indigenous companies Famfa and Noreast on a discretionary basis and, thereafter, made it a state policy not to grant leases anywhere in its territory to foreign companies.

During the ensuing period, a series of farm-ins and farm-outs have occurred. Amoco, which had no lease to operate, farmed into Agip's OPLs 211 and 316, Exxon's OPL 209, and Mobil's OPL221, owning a total of 3,140 sq km (net) of acreage. Exxon, with only one lease to operate, farmed into Shell's OPLs 212 and 219, Elf's 222 and 223, Agips 211 and 316, as well as Conoco's OPL 220. Texaco farmed into all three leases operated by the BP/Statoil alliance: OPLs 213, 217, and 218 as well as Famfa's OPL 216. Mobil took a hefty stake in Noreast's OPL 215 and Chevron and CanOxy became partners with Exxon in Elf's OPLs 222 and 223.

By January 1995, more than 20,000 sq km of 3D seismic data had been acquired over the 15 deepwater leases awarded between 1992 and 1995. These complemented and provided infill data for the 9,600 km of earlier coarse grid 2D seismic data. Drilling started in July 1995 with much anxiety. There had been misgivings that the farther offshore into the Niger Delta region, the more likely the discovery product would be gas. But the pioneer well, Allied Energy's Oyo-1, proved an oil discovery, even if marginal. Since then, 31 more wells have been spudded.

Spectacular Discoveries (back to top)

The spectacular discoveries have been Shell's Bonga (OPL 212), Statoil's Nnwa (OPL 218), Elf's Ukot (OPL 222), Famfa's Agbami (OPL 216), and Exxon's Erha (OPL 209). The more modest discoveries have been Conoco's Chota (OPL 220) and Agip's Abo (OPL 316). The Bonga Field is undergoing development and is scheduled to come onstream by 2002, with 200,000 b/d oil at peak. Famfa has commenced drilling the outpost of Agbami, and Exxon should spud the first appraisal of Erha by September.

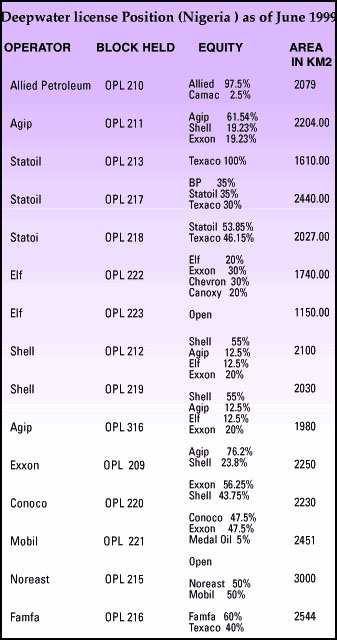

The results of all this drilling activity has led to re-arrangement of the ownership-equity pattern. The BP/Statoil alliance broke down last year after five consecutive wells in four leases failed to yield more than oil or gas shows. BP was preparing to leave Nigeria even before its merger with Amoco, so by the time Statoil discovered Nnwa (est 500 million bbl oil), in OPL 218, BP had pulled out of the partnership. Expectedly, Texaco, as third partner, exercised its rights and now holds 46.15% to Statoil's 53.85%. BP and Statoil have relinquished their stakes in OPL 213. Texaco now holds a 100% stake in the lease and has become operator.

Chevron, Exxon, CanOxy, as well as operator Elf have pulled out of OPL 223, leaving the lease open. Amoco has exited the four leases where it held equity. In the highly prospective OPL 209 (in which the huge Erha discovery is located), Shell and Exxon exercised their rights to first option and split the Amoco stake, ending up with a 56.25%(Exxon) and 43.75%(Shell) share. Exxon has itself pulled out of Agip's OPL 316 which holds the Abo Field and curiously increased its stake in OPL 211 (where there hasn't been any find) from 12.55% to 19.23% in wake of Amoco's exit.

Nigeria vs Angola (back to top)

The shifts in Nigerian lease holdings suggest the majors are more comfortable investing in Angola. While BP and Statoil were parting ways in Nigeria, they were strengthening cooperation in Angola. In Elf-operated deepwater Block 17, BP/Statoil holds 30%, equally shared. In the successful Exxon lease Block 15, BP-A holds 26.65%, while Statoil holds 13.33%. The BP-A/Statoil alliance holds 40% of the recently signed in the ultra-deepwater lease Block 31.

Amoco, never an operator in Nigeria, has just started full scale drilling in deepwater Angola. Now operating as BP-Amoco, its first well, Platina-1tested a cumulative 4,746 b/d oil in two significant intervals. It has recorded another success in its second well, Plutonio-1 which reached a TD of 11,779 ft at the end of May. The well encountered more than 100 ft net oil in two sands. Plutonio-1 tested 3,400 b/d of 35° API oil in 32/64" choke in several zones. (Exxon and Elf have done extremely well in deepwater Angola, discovering field after field with reserves in excess of 400 million bbl oil each.)

Shell is the exception in this comparison. While it is the only company in Nigeria developing a deepwater field, its Angolan operations have faired poorly. Nevertheless, Shell's performance in Nigeria is an indicator of the promising future of the country's deepwater. Shell, after all, is more research-oriented than other companies, excluding Exxon, and the two have made spectacular finds in deepwater Nigeria.

Geology of Deepwater Nigeria (back to top)

Deepwater Nigeria is made up of both the deepwater Niger Delta Basin and the much smaller deepwater Benin Basin, west of the Niger Delta Basin. The offshore Niger Delta complex comprises 30,000 sq miles, extending to the lower continental slope and the Nigerian escarpment. The Delta extends into the deepwater beyond the lower part of the complex towards the Guinean Abyssal plain, which includes 36,000 sq miles of the lower part of the continental rise. The average gradient from the shelf break to the slope is 1:34, but extensive deformation of the slope by gravity tectonic processes has created numerous intraslope basins that give rise to much steeper and variable local gradients. The slope gives way to the more gentle continental rise—average gradient 1: 3500—which continues seaward until it merges with Guinean Abyssal Plain.

Three regional styles from the outer continental shelf to the continental rise have been recognized:

- An upper extensional zone of listric growth faults beneath the outer shelf.

- A translational zone of diapirs and shale ridges beneath the upper slope.

- A lower compressional zone of toe thrusts beneath the lower slope and rise.

Interpreted collectively, these styles indicate large portions of thick sediment proism slowly moving downslope by gravity sliding. The resulting deformation has created local intraslope basins up to 25 km wide generally filled with mass transport deposits up to several km thick.

Within the major structural framework, seismic facies indicate truncated strata, mounded forms, hummocky reflections, etc, which are regularly interpreted as channels, intraslope floor fans, channel-levee systems, canyons terminal lobes, slumps, and debris flows resulting from mass transport and turbidity currents. Ponded slope stratification regularly occur, between diapirs and between huge mounded swells of strata.

Until recently, operators have generally targeted structural plays and ignored stratigraphic traps. The first well in the terrain, Oyo-1 (WD=350m) by Allied Petroleum, was drilled on ponded slope turbidites, supported by a fault. Shell's Bonga discovery was drilled on the flank of a broad four way closure, interpreted by Shell as a clay-cored anticline. The most extensive of the five oil-filled reservoirs encountered in this well are amalgamated channel and sheet sands deposited in a middle to upper slope environment.

Agip targeted a 2,000-meter thick sand/shale sequence by drilling through the crest of a four-way anticlinal closure in Abo-1 (500 meter water depth, OPL 316). They were deceived by the amplitude contrasts that suggested stratal interfaces. Instead of a sand/shale parallic sequence, they drilled through a shale swell. Statoil's Boi-1 well (OPL 213) , another a four-way, (albeit fault-supported) closure, also resulted in a duster. It turned out that the fault that was meant to aid the closure was a conduit through which hydrocarbons escaped.

Of the first 12 wells drilled, three were successes. It took a while for operators to understand deepwater Niger Delta's oil machine. But the last five wells have had 80% success. Now, with 32 wells spudded, 13 have encountered testable oil. Hydrocarbon occurrence has risen to 25 out of 32. The percentage of testable hydrocarbon is 64%; testable oil is 48%.

What have operators done right all of a sudden? Rather than focusing on structural plays, as in the beginning, recent spectacular finds have revealed the importance of understanding the stratigraphy and sediment transport.

Most structural plays drilled were drilled in the upper shelf (<500 meters) because it was cheaper, and most of the sands weren't well developed. Now, however, operators are going for the middle shelf trend, where the sands are better developed. And, operators have learned to use seismic attributes better, especially to define stratigraphic trapping.

The Business Environment (back to top)

With four large discoveries—Ukot-1, Agbami-1, Erha-1, Nnwa-1—coming one after the other between October 1998 and February 1999, optimism has replaced earlier misgivings about deepwater Nigeria. With Shell's Bonga, these discoveries are ranked the "Big Five" of deepwater Nigeria. Even though the overall picture looks less promising than Angola's, the Nigerian deepwater region appears as much a potent business force as onshore/shelf Niger Delta.

Agip is trying to develop the Abo complex, on which it has three wells, even though reserves are not as large as any of the Big Five. The economics looks good, however, with 200 million bbl in recoverable reserves in what is the shallowest lease (Abo is in 350 meters water), and the company considers producing through facilities like Chevron's Opolo, 35 km eastwards.

Shell will make its final investment decision on Bonga at the end of this year. The proposal is to put the field onstream in the year 2002, with 200, 000 b/d oil at peak production—more than 25% of Shell's current production in the country.

Texaco is drilling Agbami-2 to appraise the intervals discovered in Agbami-1. Although the lease, OPL 216, is held by the indigenous company Famfa, the technical partner is Texaco. With 40% ownership, it is paying all the bills now. Although Texaco's public statement noted that Agbami holds "hundreds of millions of bbl", the company's officials privately confirm that the field is their largest discovery in 30 years. Exxon's Erha and Statoil's Nnwa (OPL 218) reportedly have more than 400 million bbl estimated recoverable reserves each as well. Nnwa's fortunes is underscored by Shell currently drilling well Doro-1, which is meant to confirm the extent of the Nnwa structure in nearby Shell acreage OPL 219.

Exxon proposes to drill an appraisal of Erha this month and with its lush Angolan Block 15 to develop, has so far been cool about its Nigerian deepwater plans.

After four years since the first well, Nigeria's deepwater industry is finally settling down. New competitors have entered the play. Total Upstream Nigeria, the affiliate of Total-Fina is working the highly prospective lease OPL 246, with Total the technical partner to indigenous owner, Star Atlantic Petroleum. Petrobras is here, but details of what it has are still hazy. And there have been inquiries from South Africa's aggressive exploration company Energy Africa , and Malaysia's Petronas.

With 33 new leases to the west and south of existing deepwater leases, competitors have an array of choices. But these ultra-deepwater leases are in waters between 2,000 and 3,000 meters deep.

It looks like Nigeria's deepwater area will be an interesting scene of activity for the foreseeable future. As a result of talk about a new deepwater bidding round, operators have accelerated their response to the geophysical company Veritas, which has acquired 10,000 km of 2D in those new acreage, and with the 16 formerly allocated licenses now open, PGS's 3D non-exclusive spec data in that area is also open.