Shell Invests In PowerNap Subsea Tie-Back In Gulf Of Mexico

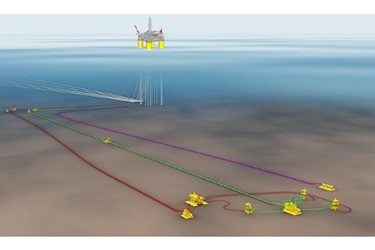

Shell Offshore Inc. (Shell), a subsidiary of Royal Dutch Shell plc, has taken the final investment decision (FID) for the PowerNap deep-water project in the US Gulf of Mexico. PowerNap is a subsea tie-back to the Shell-operated Olympus production hub.

The project is expected to start production in late 2021 and produce up to 35,000 barrels of oil equivalent per day (boe/d) at peak rates. It is anticipated to have a forward-looking break-even price of less than $35 per barrel and is currently estimated to contain more than 85 million barrels of oil equivalent recoverable resources.

"PowerNap further strengthens Shell’s leading position in the Gulf of Mexico,” said Wael Sawan, Shell’s Upstream Director. “It demonstrates the depth of our portfolio of Deep Water growth options, and our ability to fully leverage our existing infrastructure to unlock value,” he added.

Shell has a leading deep-water portfolio with an exciting development funnel and strong exploration acreage in the US Gulf of Mexico, Brazil, Nigeria and Malaysia heartlands, as well as in emerging offshore basins such as Mexico, Mauritania and the Western Black Sea. Shell currently is the largest leaseholder and one of the leading offshore producers of oil and natural gas in the US Gulf of Mexico.

- Shell discovered PowerNap in 2014. 100% developed by Shell, it is located in the south-central Mississippi Canyon area approximately 240 kilometres (150 miles) from New Orleans in about 1,280 metres (4,200 feet) of water.

- The Shell-operated (71.5%) Olympus production hub is co-owned by BP Exploration and Production Inc. (28.5%). Production at Olympus began in 2014.

- PowerNap production will be transported to market on the Mars pipeline, which is operated by Shell Pipeline Company LP and co-owned by Shell Midstream Partners, L.P. (71.5%) and BP Midstream Partners LP (28.5%).

- Shell continues to be a leading operator in the US Gulf of Mexico, operating nine production hubs and a network of subsea infrastructure.

- The forward-looking break-even price presented above is calculated on all forward-looking costs associated from FID. Accordingly, this typically excludes exploration and appraisal costs, lease bonuses, exploration seismic and exploration team overhead costs. It is also calculated based on our estimate of resource volumes that are currently classified as 2p and 2c under the Society of Petroleum Engineers’ Resource Classification System. As this project is expected to be multi-decade producing, the less than $35 per barrel projection will not be reflected either in earnings or cash flow in the next five years. The currently estimated peak production and 2p/2c recoverable resources presented above are 100% total gross figures.

Source: Shell Offshore Inc. (Shell)