U.S. Midstream Water Market Totals US$156B From 2025–2030, Anchored By Surging Production In The Permian Basin

Water management now plays a central role in the economics of U.S. oil and gas production. From sourcing and transport to treatment and disposal, the scale and cost of handling water have become defining factors in drilling strategies, infrastructure investment, and ultimately, U.S. energy security.

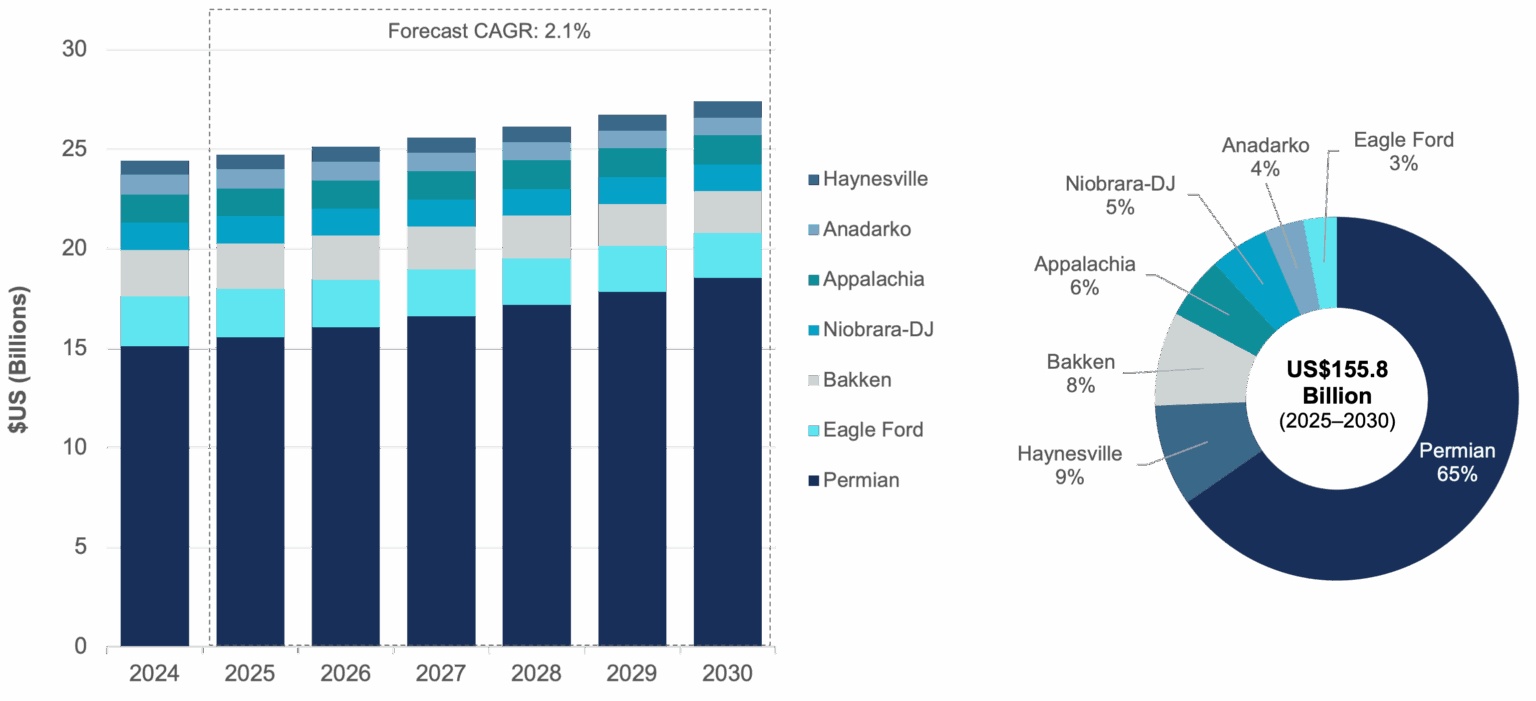

A new Insight Report by Bluefield Research indicates that the U.S. midstream water market for oil and gas is projected to reach a total of US$156B between 2025 to 2030 with an average of over US$26B per year at a 2.1% compound annual growth rate. This market expansion is driven by robust energy demand, both domestically—supporting growth industries like data centers for artificial intelligence—and internationally, through newly formed export markets in Europe and Asia.

“For exploration and production companies, midstream water has shifted from a secondary concern to a priority for operational performance,” says Sophie Washington, a senior analyst at Bluefield Research. “As operators face increasing water volumes and seismic risks, more efficient water management and strategies will be key to reducing costs and ensuring reliable production.”

Water: A Critical Factor of Shale Economics

Midstream water—which includes supply, transport, storage, treatment, and disposal—plays a pivotal role in the completion of oil and gas wells. Transporting water—be it freshwater supplies for operations or produced water generated as a byproduct of oil and gas extraction—accounts for 43% of total water-related costs incurred by operators. Due to escaling transport costs, increasing prices for freshwater, and tightening disposal regulations, recycled produced water is projected to supply more than 75% of U.S. hydraulic fracturing demand by 2030.

“A 1,500% surge in seismic events in the Permian Basin between 2017 and 2022, combined with rising volumes of produced water, has made investments in reuse and pipeline infrastructure far more compelling than a decade ago,” says Washington. “These shifts underscore water’s role as a critical input shaping longer-term operational and investment decisions.”

Exhibit: U.S. Oil & Gas Operator Water Management Spend by Category & Basin, 2024–2030

Permian Basin Dominates U.S. Market Opportunity

The Permian Basin will drive the majority of U.S. midstream water spend, accounting for US$101.8B through 2030—nearly two-thirds of the U.S. market value. The basin alone is expected to require an average of 46.5B gallons of water annually for new well completions through the forecast period. Secondary growth basins include the Eagle Ford (US$14.1B) and Bakken (US$13.0B), while the Appalachian Basin remains strategically important for natural gas production and U.S. liquefied natural gas exports.

Basin-specific dynamics, such as topography, transportation logistics, and disposal options, shape the regional challenges and opportunities for midstream water players.

Infrastructure Investment Targets Reuse and Efficiency

Over the next five years, US$16Bin capital expenditures is projected for water-related infrastructure—including pipelines to reduce reliance on trucking, disposal wells facing regulatory scrutiny, and recycling facilities to enable reuse at scale. Collectively, investments in these assets represent a strategic pivot toward efficiency, positioning operators to lock in long-term cost advantages while addressing environmental and regulatory requirements.

Increasingly water-intensive drilling techniques, such as longer horizontal wells, are also reshaping infrastructure investments. The average horizontal well currently reaches 12,000 feet and uses 7.8 million gallons of water, with supermajors like ExxonMobil and Diamondback Energy pushing well lengths in the Permian Basin beyond 20,000 feet, nearly four miles, setting new water demand benchmarks.

A Maturing, Consolidating Competitive Landscape

The volatility of energy markets over the past decade has accelerated consolidation and vertical integration across the midstream water value chain. Since 2020, 32 water mergers and acquisitions have redefined the playing field, as acquisitive firms seek scale and vertical integration. Leading operators include Select Water Solutions, Aris Water Solutions—recently acquired by Western Energy Solutions—and WaterBridge, which debuted its initial public offering on 17 September 2025.

Together, these firms manage more than 14,000 miles of pipelines and hundreds of produced water treatment facilities, positioning themselves as basin specialists with integrated solutions and partnership agreements with leading exploration and production companies.

“The market’s maturation is reflected in the greater strategic and financial discipline shown by companies after years of volatility and consolidation,” Washington adds. “With just over a decade of large-scale shale development behind it, the sector’s next chapter will increasingly be defined by more deliberate and innovative water strategies.”

About Bluefield Research

Bluefield Research supports strategic decision makers with actionable water market intelligence and data in the global industrial and municipal sectors. With expertise spanning infrastructure, policy, and technology, Bluefield helps companies understand where the market is going—and why.

This Insight Report, U.S. Midstream Water for Hydraulic Manufacturing: Market Trends, Opportunities, and Forecasts, 2025–2030, presents a comprehensive analysis of U.S. midstream water management, encompassing market drivers and forecasts, basin-level dynamics, and the strategies of leading players that are influencing the future of oilfield water management. The full report is available for purchase and immediate download.

Source: Bluefield Research